The Evolving EII Levy Exemption Scheme and How it Reduces Your Bills

The EII (Energy Intensive industry) levy exemption scheme is set to change over the next year. It’s changes are designed to save eligible businesses money from their non-commodity charges and keep them competitive internationally. In this article we will analyse how the changes translate into concrete savings, when they take place, and proposed future changes.

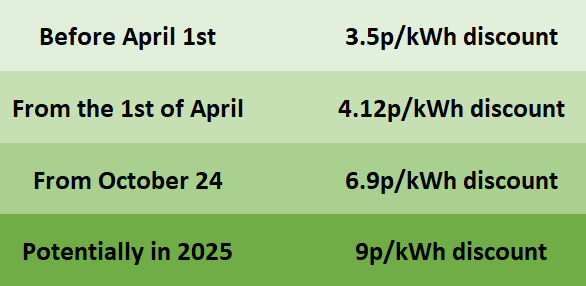

Changes to current discount rates

Currently the scheme offers businesses operating within eligible industries discounts on non-commodity costs. At the moment, the scheme offers an 85% discount on Renewable Obligations (RO), Feed-in Tariffs (FiT), and Contracts for Difference (CfD). This is due to change on April 1st, with the discounted rate increasing from 85% to 100%. With the current 85% discount, it is estimated that these savings equal approximately 3.5p/kWh consumed.

Capacity Market changes

In October 2024 Capacity Market charges are set to be added to the exemption. This will add a further discount of approximately 2.8p/kWh to the non-commodity charges paid per unit of electricity consumed.

DUoS charges

Reviews are currently taking place looking at the viability of including DUoS (Distribution Use of System) charges within the exemption scheme, with a view of adding them to the list of exempt charges in 2025. If these are included this could lead to the total discount being worth approximately 9p/kWh.

Projected Savings

For an eligible business that is currently consuming 25,000 kWh per month at a current rate of 30p/kWh, they will be paying 26.5p/kWh when factoring in the current discount. Under the current scheme, their monthly expenditure is £6,625. With the enhanced scheme, they could expect to be paying £5,770 when the further discount takes effect in October. And if the DUoS charges are added to the exemption scheme, their monthly costs would fall to £5250, representing an over 20% discount from their current electricity costs.

The evolution of the EII Energy Scheme marks a pivotal moment for energy-intensive industries in the UK. By focusing on comprehensive relief for non-energy costs, coverage of network costs, and strategic exemptions, the enhanced scheme paves the way for substantial savings. As April 1, 2024, approaches, businesses are encouraged to assess the changes and seize the opportunities for enhanced competitiveness and financial efficiency.

If you need help checking your eligibility or applying for the scheme, reach out to us today. We can assist your business in ensuring you receive all of the eligible discounts.

Contact Us for assistance with the EII levy exemption scheme

We will get back to you as soon as possible.

Please try again later.

SITE MAP

CONTACT US

Registered Office: 40 Gorse Farm Road, Nuneaton, Warwickshire, England, CV11 6TH