May 2025 Review

May Review

By Adam Novakovic

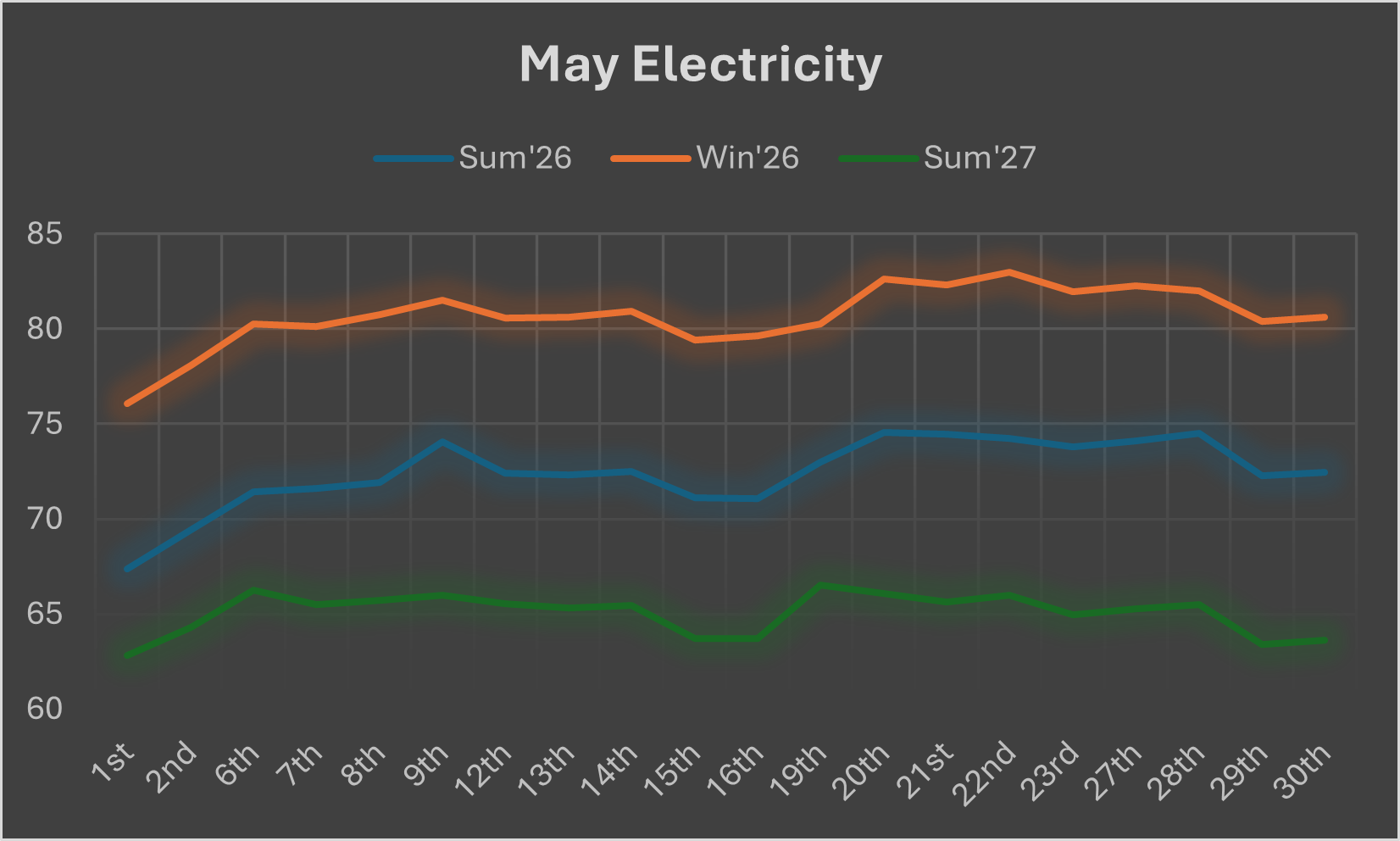

As Summer kicked into gear, we saw a small jump in the wholesale energy markets at the start of month before the prices began to stabilise.

Looking at the Summer’26 electricity prices, they rose 7.26% over the month, resulting in an increased cost of over £1250 for a business expected to consume 250,000kWh over the period.

So why did the prices rise during May?

In 2024, Norway’s Troll gas field achieved record levels of production. However, May would start with unexpected outages at the field limiting the amount of LNG that can be sent to mainland Europe. With scheduled maintenance already taking place at Norway’s Nyhamna processing plant and the Aasta Hansteen field, this caused a spike in the price of gas, with more European nations being forced to consider increasing their levels of LNG cargo imports.

There was more negative news from Europe’s renewables sector. While many had enjoyed a warmer-than-expected Spring, this had come at the cost of lower wind levels. Wind speeds in Europe from February-April showed their largest decrease from the averages since the 1940s, with examples of average wind levels being 30% lower than 12 months before. This has limited the amount of energy capable of being produced from wind and has further contributed to the rise in energy prices.

There was positive news as European gas reserves are being refilled at a faster than expected rate. Gas storages are being replenished across the UK and the EU at a rate more than 50% faster than in 2024. And talks are continuing about softening the November deadlines for all EU countries to achieve 90% storage levels. With these actions set to remove some of the existing buying pressure on the market, it could blunt the extent of the negative response to any future supply shortages.

Outlook

Despite the reduced buying pressure, it seems as though multiple catalysts are in place that could drive prices up in the coming months. With the EU confirming their plans to completely ban the importation of Russian gas by the end of 2027, it seems that even further progress in Russian/Ukrainian peace talks may not be enough to cause another significant drop in prices. Supply news regarding UK/EU imports from the US and Asia may now take on extra importance and the market will likely react more sharply to any negative news impacting these supply chains.

Asian demand for LNG has been muted so far this year, aided by China reselling part of it’s LNG reserves. This looks to remain steady for the short-term future, but any forthcoming rises will likely send prices higher.

With talks of a potential conflict between Israel and Iran expected to ramp up over the coming month, this could have a strong negative impact on prices, with any hostilities almost certain to impact how energy is exported from the region.

It seems as though the potential to prices to rise further outweighs the chance of prices continuing their 2025 trend of dropping. Without negative news, and with Norwegian export capacity returning to it’s previously high levels, there is the possibility of prices dropping, but the risk of one piece of bad news spiking prices will remain for the near future.

If your business requires advice with its energy procurement, management, or planning, then don’t hesitate to contact Seemore Energy to speak to experienced advisors who can help you with bespoke strategies and advice that is tailored to your needs.