Why UK Energy Prices Keep On Rising…

Why UK Energy Prices Keep On Rising…

And what it means to manufacturing and engineering companies over the next few years

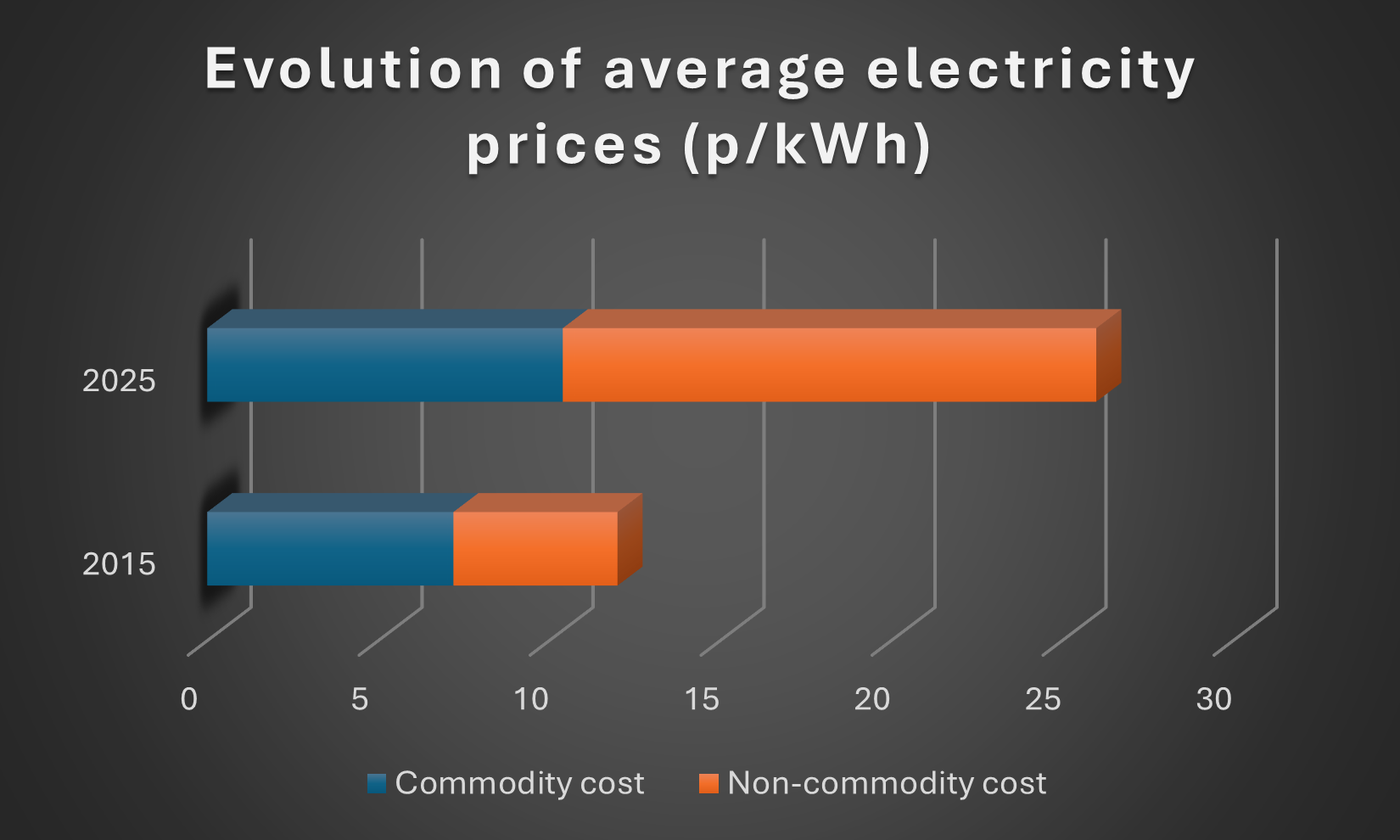

Over the past decade, UK energy prices have changed dramatically. Not only in terms of overall cost but also in how those costs are made up. Ten years ago, the largest part of a business electricity bill came from the commodity element: the wholesale price of electricity.

Non-commodity charges -- often used to support the infrastructure of the electricity grid or government energy policies -- were relatively modest.

In 2013, the typical breakdown of electricity costs for a business user was around 60–65% commodity and 35–40% non-commodity. Today, that picture has flipped. For many manufacturers, non-commodity charges now make up over 60% of the total bill, with the non-commodity percentage of the bill increasing each year.

This shift explains why energy bills have remained stubbornly high, even during periods when wholesale prices fell. Grid reinforcement, renewable subsidies, and balancing costs have grown year on year, with these costs baked into every unit of power consumed, regardless of wholesale prices.

Current Charges and Reasons Behind Them

To understand why UK energy prices keep climbing, we first need to look at the charges already included in energy bills and the reasons they are part of your total energy cost.

Grid Expansion

The UK grid was designed in an era of large, centralised fossil-fuel power stations. As renewables have expanded, the grid needed to be upgraded to handle more decentralised and intermittent generation sources – such as wind and solar. These upgrades are expensive, and the cost is passed down to consumers through transmission and distribution charges.

With some of the UK’s largest windfarms based offshore in Scotland, it has required significant investment for the grid to be able to incorporate these new forms of electricity generation. Estimates have suggested that over £60bn will be spent on grid expansion over the next decade and this will be funded by the end user via various non-commodity charges.

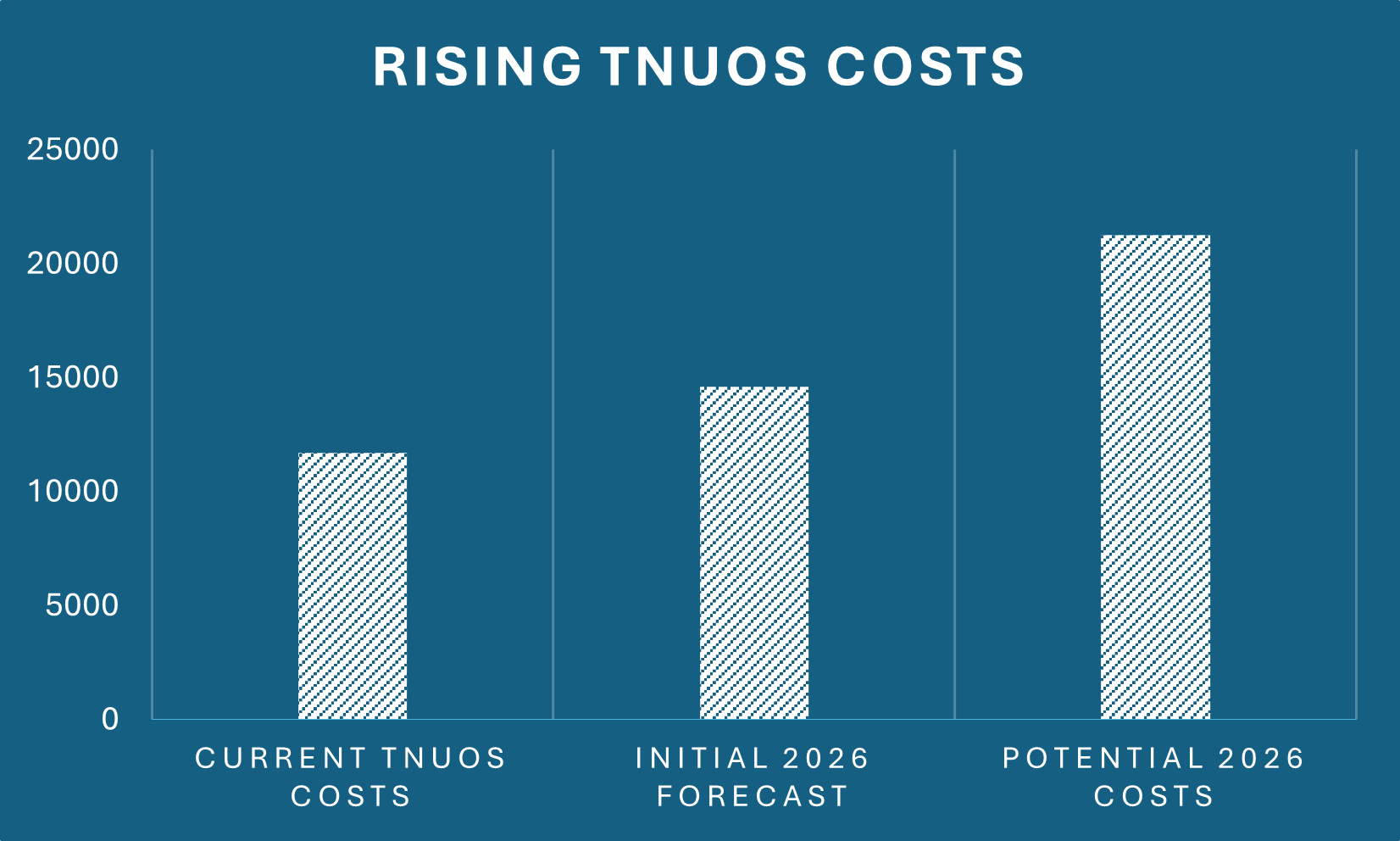

For a manufacturing plant consuming 10 GWh per year, grid charges alone can now account for well over £300,000 annually.

Worryingly, these charges could increase significantly in the next 12 months. The Transmission Network Use of Systems charge (often listed as TNUoS on invoices) is one of the non-commodity charges that funds the maintenance and expansion of the grid. OFGEM are the independent regulatory body responsible for gas and electricity, and they recently published guidance which will permit the owners of the grid to increase their charges by over 80%. It had previously been predicted that there would be a 25% increase in TNUoS costs for 2026, but this estimate may need to be revised before a final decision is announced later this year.

Renewables and Green Subsidies

The UK government’s commitment to decarbonisation targets has come at the end user’s expense. Mandates have been created to support renewable energy developers, but with the funding needing to be provided through further non-commodity charges. Schemes such as the Contracts for Difference (CfD) mechanism and the Renewables Obligation (RO) are funded through levies applied to bills. While these schemes have been crucial for encouraging investment in wind and solar, the costs are far from negligible. Manufacturers may find that as much as 20% of their bill goes towards these green subsidies. This subsidising of environmentally friendly initiatives has created an uneven playing field for British businesses competing internationally. In nations such as France and Germany, governments have funded these schemes through taxation, which allows their businesses to have lower energy costs than their British counterparts.

Grid Balancing Costs

With more renewable generation comes increased volatility. Whilst a nuclear power plant can accurately forecast the amounts of electricity it will generate, the wind doesn’t always blow when demand peaks. NESO (National Energy System Operator) must constantly balance supply and demand to keep the lights on. This requires backup generators, battery storage, and even payments to turn down industrial usage at times of stress. The cost of these balancing services – which is listed on invoices as Balancing Services Use of Systems charge (BSUoS) -- has more than doubled in recent years, with 2022 seeing balancing costs rise above £4 billion. For an energy-intensive manufacturer, this translates into tens of thousands of pounds annually in costs that provide no direct benefit to their operations.

Together, these charges form a series of costs that often outpace the wholesale energy price. While wholesale prices may decrease at times, the steady rise of non-commodity charges has meant energy bills are showing no sign of returning to the prices of pre-Covid-19 pandemic.

Over the next five years, analysts forecast a further 10–20% rise in non-commodity costs as new grid reinforcements and subsidy schemes are rolled out. For our 10 GWh manufacturer, that could mean an additional £90,000–£120,000 per year on top of today’s already heavy burden. Crucially, this increase will come even if wholesale energy prices remain steady or fall.

This is why the choice of supplier and contract product matters more than ever. By choosing the right supply contract, you can smooth the impact of these costs into your budget rather than experience unexpected costs when the supplier chooses to pass costs on.

By having an experienced energy partner, you can be advised on which suppliers have historically been the quickest to add new charges to your bill. They can also offer guidance on upcoming charges and whether it’s more beneficial to agree some of the non-commodity charges in advance, or whether they would be better left as pass-through charges.

Future Charges

In addition to the existing charges you can find on your invoice, there are two new charges set to be added in the next 12 months.

NRAB Levy (Network Reinforcement Adjustment Balancing)

From this autumn, the NRAB Levy will begin to appear on electricity invoices. This charge is being used to fund the construction of nuclear plants in the UK. Whilst this will have the long-term effect of lowering energy costs – with nuclear being one of the most cost effective methods of generating electricity – it will add an estimated 0.345p/kWh on to current electricity costs.

RIIO-ET3

This charge is set to be introduced on April 1st 2026, and will run until March 31st 2031. The aim of RIIO-ET3 is to generate money to allow for large-scale investment into the infrastructure of the energy transmission network, increasing resilience, reliability, and capacity. Depending on meter type and consumption levels, for most manufacturing and engineering sites, this is expected to add an annual cost of between £6,000-£990,000 for the duration of the charge.

Pressures on Directors

For manufacturing directors, energy costs aren’t just another overhead, they directly influence competitiveness and profitability. Many manufacturers agree multi-year contracts with their buyers, fixing the price of their goods in advance to secure orders. Energy contracts, however, don’t always align. If electricity or non-commodity charges increase mid-term, a business could find itself committed to delivering products at a price that no longer covers its energy input costs, effectively selling at a loss for the remainder of the contract.

Consider a steel manufacturer that fixes its product price at £500 per tonne for a three-year supply contract. At the time of signing, energy costs amount to around £100 per tonne produced and there is a 5% profit margin. If non-commodity charges and balancing costs rise by 30% mid-contract, the energy cost per tonne jumps to £130. With thousands of tonnes under contract, this translates to a loss of £5 per tonne produced.

This is why staying ahead of the curve is so critical. Directors who can anticipate rising non-commodity costs or wholesale price movements and factor them into their product pricing strategy will protect their margins. Those who don’t risk being trapped in agreements that negatively impact profitability.

Budgetary certainty and business modelling must go hand in hand. Energy budgets can no longer be treated as a rolling annual exercise but need to be integrated into long-term commercial strategy. By ensuring that procurement timelines, contract structures, and sales agreements all align, directors can safeguard against unexpected shocks and maintain control over their margins.

In short, energy needs to be viewed as a strategic risk factor. The businesses that survive and thrive will be the ones that appreciate its role in their financial planning.

What Businesses Can Do to Prepare

Rising non-commodity charges are unavoidable, but businesses can take clear steps to reduce the impact.

1. Secure Entitlements

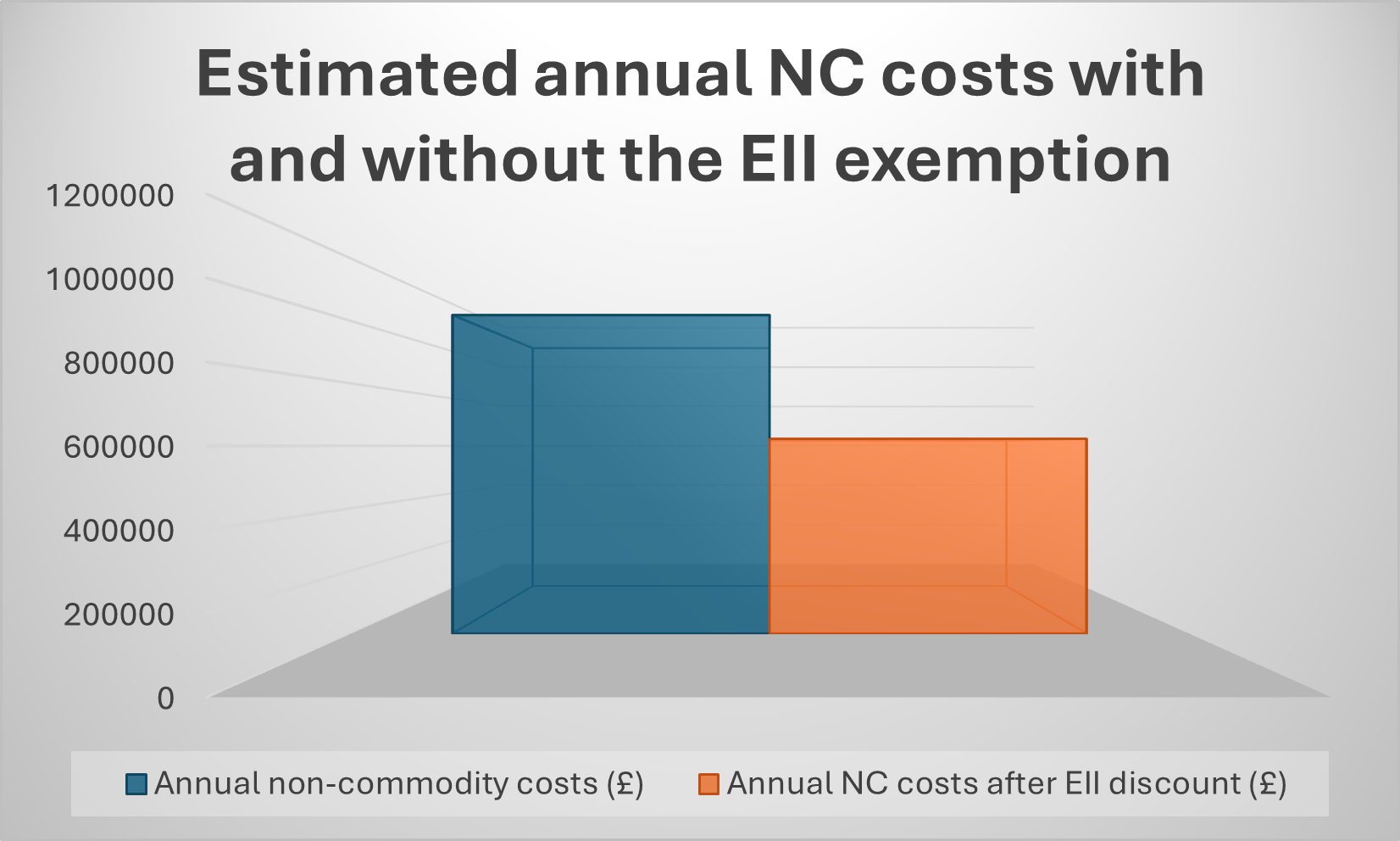

The most immediate priority is ensuring you’re receiving every government discount available. The Energy Intensive Industries (EII) exemption

scheme can cut certain policy costs by up to 85%, often

saving eligible manufacturers

hundreds of thousands per year. Many businesses are currently missing out simply because they haven’t checked eligibility.

2. Optimise Costs

Savings can also be found in how charges are applied:

- kVA analysis ensures you’re not overpaying for unused capacity.

- TCR banding reviews help confirm you’re in the right charging group.

- Volume optimisation reduces exposure to costly peak charges.

Case study: A medium-sized plastics manufacturer consuming 5 GWh per year reduced its agreed capacity by 550 kVA after an audit. This cut unnecessary charges by almost £22,000 annually.

3. Build Long-Term Resilience

For a strategic hedge, self-generation is becoming more attractive. Solar panels and battery storage can reduce reliance on the grid and protect against volatility. Whilst upfront investment is significant, the long-term payback is accelerating as grid charges rise.

By showing foresight and combining government entitlements, cost optimisation, and long-term investment, manufacturers can bring energy costs under control and build resilience into their budgets. Those who wait until charges kick-in will find far fewer options available.

Conclusion

UK energy prices currently show no sign of returning to pre-Covid levels as non-commodity charges rise and the government funds its green transition. For manufacturers, this can lead to precarious situations.

However, by understanding the breakdown of costs, anticipating future charges, and making use of schemes like the EII exemption, businesses can plan their budgets with increased levels of certainty.

At SeeMore Energy we offer a free, no-obligation review to check if your business is eligible for relief schemes, alongside a utility budget consultation tailored to your operations. With the right energy partner, you can turn today’s energy challenges into a manageable part of your business strategy.

If your business requires advice with its energy procurement, management, or planning, then don’t hesitate to contact manufacturing@seemoreenergy.co.uk or visit www.seemoreenergy.co.uk to speak to experienced advisors who can help you with bespoke strategies and advice that is tailored to your needs.

Contact Us