April 2025 Review

April 2025 Review

By Adam Novakovic

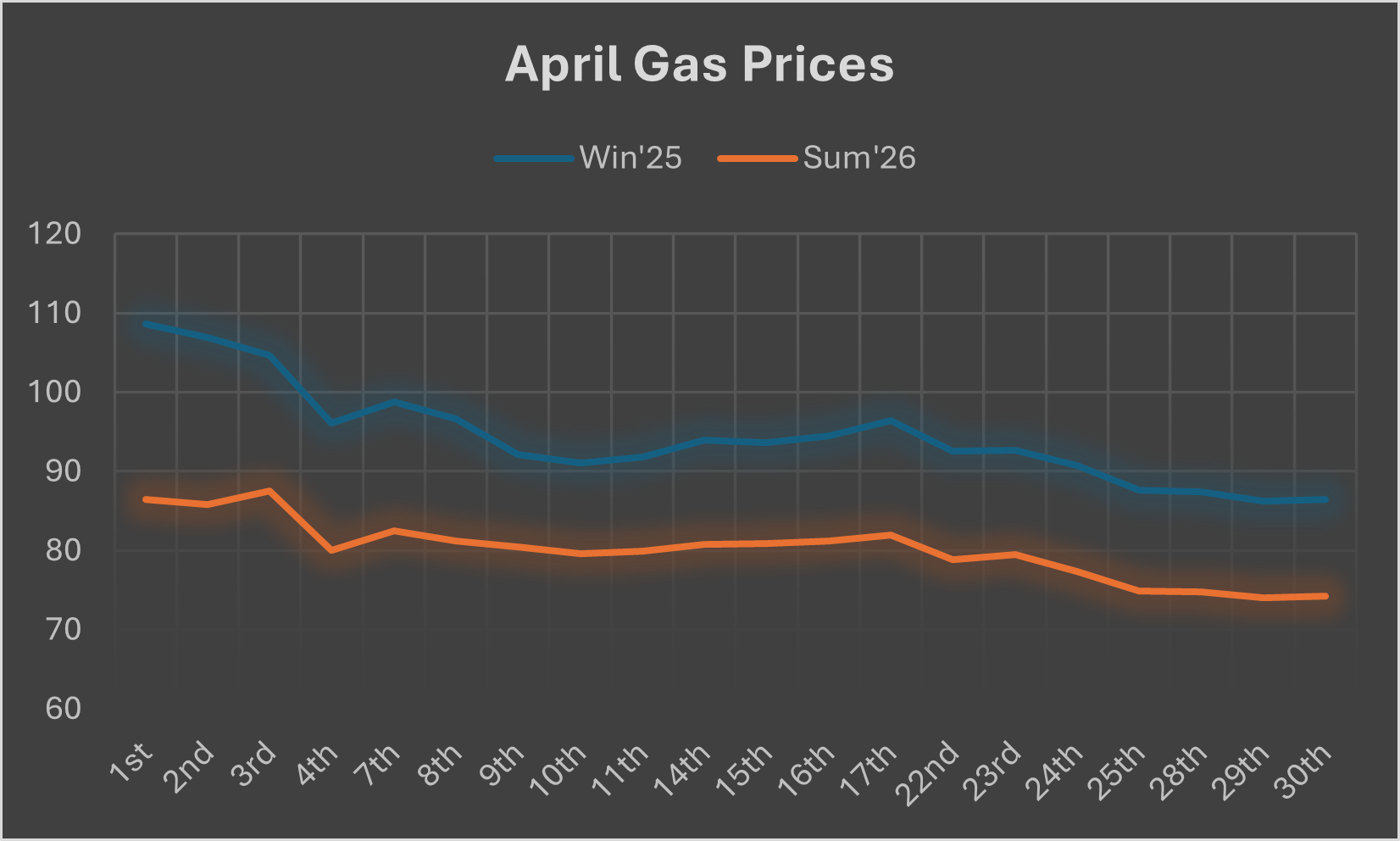

For some, April can be the cruellest of months. We saw Earthquakes cause damage in Thailand, volcanic eruptions near Iceland, and the month ended with blackouts in the Iberian peninsula. The latter highlighting the issues with switching to renewable energy sources too quickly, at the expense of energy grid stability. However, April can also be a time of great optimism as we exit the winter months and head towards the summer. The energy markets gave us plenty of reasons to be happy in the past month as wholesale gas prices fell over 20%. This drop was also seen in the gas markets for Winter’25 (a 20.42% drop) and for Summer’26 (a 14.17% drop) as prices fell, representing a good buying opportunity for those on flexible contracts.

For a business that consumes 200,000 therms during the winter period, this drop would represent a saving of £44,380, highlighting the importance of timing your purchases in the seasonal markets.

The main reason for the drop in prices throughout April was related to the US imposing tariffs on other nations, most notably China. The tariffs have affected prices in multiple ways: production levels have lowered amid exports to the US no longer being financially viable; China has imposed retaliatory tariffs on the US, with US LNG being amongst the commodities targeted; and Chinese businesses with long-term US LNG contracts are now re-selling the gas supplies, with many of the buyers being located in Europe. China has healthy LNG reserve levels and can survive without US LNG imports, however, this does free up a quantity of LNG supply to be purchased by other nations. With EU nations looking to refill their gas reserve levels in order to comply with regulations, this extra available supply is welcome news with US producers keen to find new buyers.

It wasn’t just US produced gas that is currently arriving in Europe during April. Slovakia significantly increased the amount of gas they are purchasing from Gazprom through the Turkstream pipeline. Previously they had been reliant on gas that flowed through Ukraine, and Slovakia had been applying pressure on the EU to restart the flows through the Ukrainian pipelines. However, they have now found a reliable way of importing gas and seem to be in a more secure position than many other EU nations when it comes to replenishing their gas reserve levels.

Another factor in the fall of gas prices has been unseasonably warm weather. The UK had recorded the sunniest March on record and this continued into April. The UK saw it’s 3rd warmest April as well as the hottest April temperature recorded in 7 years. This led to lower-than-expected gas consumption, but it wasn’t just in the UK where unseasonal temperatures were causing lower consumption levels. Many North African countries, particularly Egypt, were experiencing milder than usual weather during a normally hot season, leading to lower consumption. All of which is leading to increased quantities of gas being available to buyers and prices falling as demand decreases.

Outlook

While EU targets for gas reserve levels will remain a key force behind gas purchases, there are continuing talks about flexibility with the levels of reserves that need to be filled. Poland had proposed adding a 5% level of flexibility to the November deadline by which EU nations need to be at 90% reserve capacity, however, it is thought that Germany are leading other nations in pushing for the rules to change to allow a 10% deviation from the target.

The EU are also thought to be reconsidering their stance on importing Russian gas. In the aftermath of the tariffs issued by the US, many European businesses have begun to see reliance on US gas as a vulnerability, and that diversifying import options may be essential to ensure they are not exposed to potentially significant price jumps.

While supply will remain a concern, the UK is expected to see a record low level of demand from the power grid this summer. With rising solar supplies, there is expected to be a decrease in the amount of electricity transmitted across the grid during the warmer months.

With demand falling and available supply seeming to increase, it seems as though further falls in price are possible. However, the market is still volatile, and tariffs being repealed or increased conflict in Ukraine could lead to prices rising again.

If your business requires advice with its energy procurement, management, or planning, then don’t hesitate to contact Seemore Energy to speak to experienced advisors who can help you with bespoke strategies and advice that is tailored to your needs.