The Capacity Market: An untapped revenue source

The Capacity Market: An untapped revenue source

With wholesale markets volatile and network costs rising, many businesses are looking at strategies to reduce energy spend. In addition to lowering costs, there are ways that large consumers of energy can monetise their existing energy set up. By selling back unused capacity via the Capacity Market (CM), businesses can generate tens of thousands of pounds each year, without having to make any material changes to how they run their operations.

What is the Capacity Market?

The UK Capacity Market was introduced in 2014 to safeguard security of supply. The CM has two main objectives:

- Incentivise new sources of generation that can prevent issues on the demand-side.

- Provide a last-resort mechanism to prevent electricity shortages during times of system stress.

Administered by National Energy System Operator (NESO), the scheme pays providers for being available to deliver capacity during periods of system tightness. Businesses can receive payments, not for generating electricity, but for committing to reduce demand or increase supply if required.

- Capacity is secured through annual auctions (one year ahead and four years ahead), which set a £/kW price.

- Once contracted, participants receive an availability payment in return for meeting testing requirements and being ready to respond to a system stress event.

- Since the CM’s inception, there has never been a full system stress event triggered. Although precautionary notices have been issued and subsequently stood down – normally within 2 hours of being issued.

How Can Businesses Make Money from It?

For many businesses, the opportunity lies in Demand Side Response (DSR).

If a business can demonstrate that it is capable of reducing load during a stress event -- even for just 30 minutes -- that reduction can be contracted into the Capacity Market.

The process for this is:

- Historical half-hourly data is analysed to establish normal usage.

- Periods where usage dropped materially (e.g. shutdowns, maintenance, early finishes, seasonal dips) are identified.

- The difference between normal usage and the reduced period becomes the site’s deliverable capacity.

- This capacity is aggregated with other businesses into a CM Unit (CMU) and entered into the auction.

Payments are then made quarterly in arrears for being available.

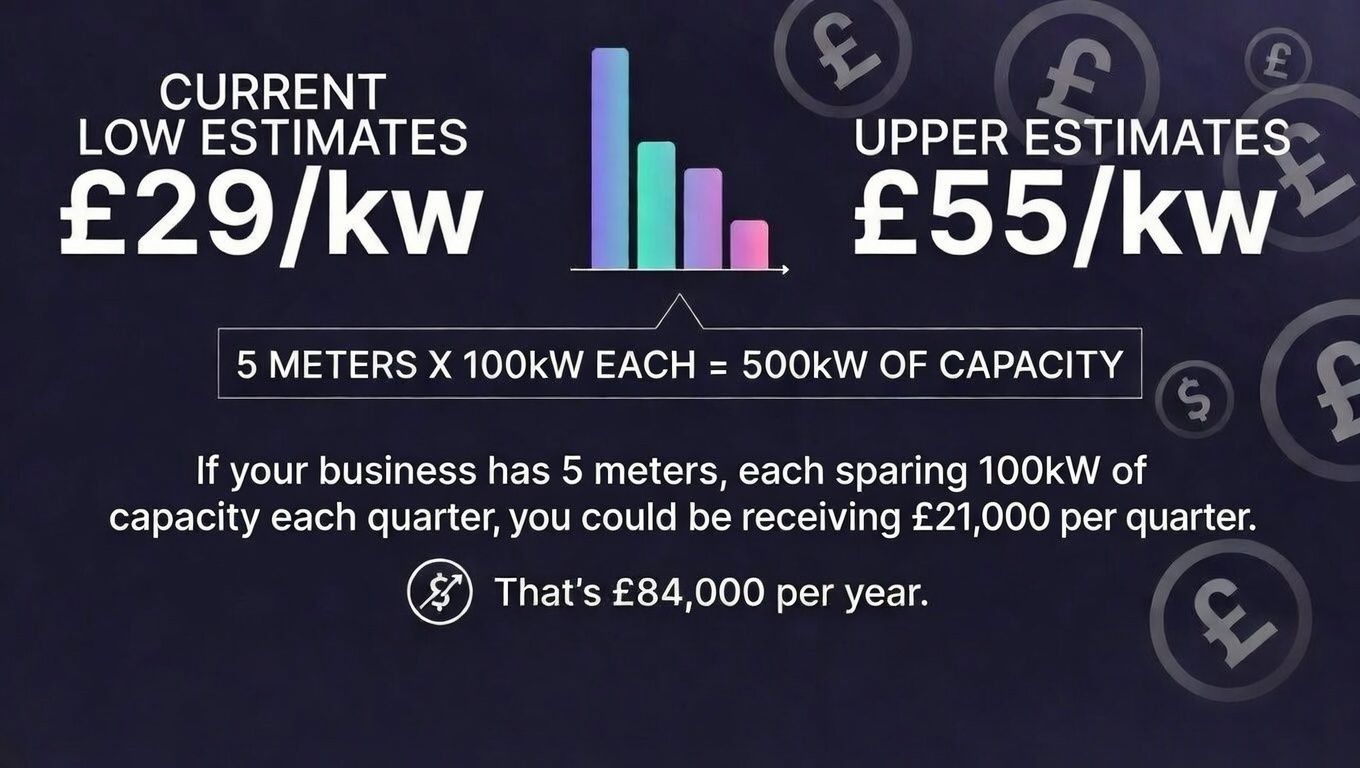

Current low estimates suggest prices of £29/kW can be achieved, while the upper estimates are around £55/kW.

Using a mid-point price, a company with 5 meters that can each spare 100kW of capacity each quarter, could receive £84,000 per year.

It should be noted that aggregators typically take a percentage of earnings in return for managing compliance, testing and portfolio balancing.

Crucially, most of the qualification and testing can be demonstrated using retrospective data, meaning businesses often don’t need to switch off equipment to pass initial tests.

The Risks and Benefits?

Benefits

- An additional revenue stream without any expenditure required.

- Payments for availability, not performance in normal operation.

- Testing requirements are minimal (30-minute windows).

In practice, many businesses find they can meet obligations during planned shutdowns or natural usage variations without many changes being required.

Risks

The primary risk arises if a system stress event is declared and the contracted capacity is not delivered. In that scenario, payments for that period may be clawed back.

However:

- Events require four hours’ notice.

- They have never occurred since 2014.

- Aggregators can balance underperformance across multiple CMUs.

- Additional capacity can sometimes be traded to cover shortfalls.

Statistically, the likelihood of a full system stress event remains low and is widely cited to be below 1%.

It’s also worth noting that if such an event were triggered, the wider electricity system would likely already be under severe strain, potentially involving brownouts or emergency balancing actions.

Why Should Businesses Consider It?

The Capacity Market is not about shutting down production at random. It’s about monetising operational flexibility that already exists.

Many businesses:

- Shut down over Christmas.

- Reduce load during maintenance.

- Run variable shift patterns.

- Can isolate non-critical equipment.

If that flexibility exists, it can be turned into contracted revenue.

In an environment where margins are tight and procurement savings are harder to achieve, the CM represents a revenue stream that can hedge against rising fixed costs and give operational insights through the analysis of consumption data.

For businesses comfortable with measured, low-probability risk -- aided by the guidance of an experienced aggregator -- the Capacity Market can be a pragmatic and commercially attractive addition to their energy strategy.

If you already have flexibility in your operations, you may already be sitting on an untapped income stream. If you would like us and our aggregator partners to review your consumption data to see whether your business has the potential to receive £10,000s per year, contact us today, and we can set up a call to talk you through the process and see how much money your business could receive.

Contact Us