The EII Support Levy (ESL)

EII Support Levy UK: Understanding the Charge and Exemptions for Businesses

The EII Support Levy UK is a new charge impacting energy bills for many UK businesses. Introduced in April 2025, this levy funds the Exemption Scheme for Energy Intensive Industries (EIIs), ensuring UK businesses with high energy costs remain competitive internationally. This guide explains what is EII Support Levy energy bills, who needs to pay it, and how to navigate EII exemption UK businesses to manage energy costs effectively.

What Is The EII Support Levy?

The EII Support Levy is a government-introduced charge added to non-domestic energy bills to support the EII Exemption Scheme. This scheme reduces energy costs for businesses classified as Energy Intensive Industries (EIIs), identified by specific SIC codes. Non-EII businesses bear the cost of this levy to offset exemptions for EIIs, helping energy-intensive sectors stay competitive in global markets.

Which businesses need to pay it?

All non-domestic UK energy users without an eligible SIC code classifying them as an Energy Intensive Industry must pay the EII Support Levy. The application of the charge varies by supplier, with some still clarifying their implementation methods. Businesses should confirm with their supplier how the levy is applied to their EII Support Levy energy bills.

How much is the charge likely to be?

The initial estimated rate of the EII Support Levy is expected to be between £0.90 - £1.40 per MWh (or £0.0009 - £0.0014 per kWh).

This means:

A business using 500,000 kWh annually could expect to pay an additional £700 per year, whereas a larger site using 2 million kWh may see a cost impact of £2,800 annually.

While this is lower than many other non-commodity charges, it’s still important for businesses to factor it into their energy budgets.

Which suppliers have confirmed how they will apply the charge?

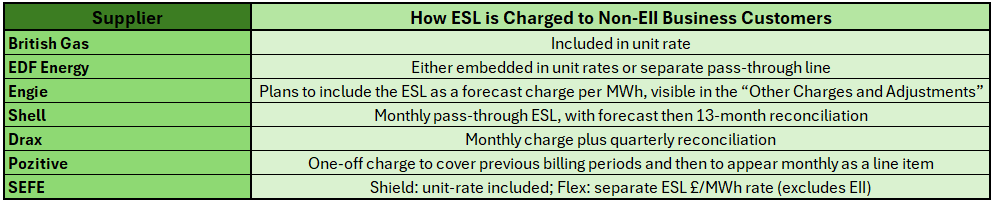

Whilst you should check with your supplier to confirm how they will be applying the charge, the following table is based on announcements made by suppliers in regard to how they plan to implement the ESL:

There are a number of suppliers who have yet to clarify how they will be applying the charges.

What do you need to do?

In order to assess whether your business your business qualifies for an EII exemption, you need to know whether your business is regarded as operating under an eligible SIC code. The full list of SIC codes can be found from page 28 on the following government document: Energy Intensive Industries (EIIs): Guidance for applicants seeking a certificate for an exemption

If your business has an eligible SIC code then you may apply for a certificate of exemption.

If your business does not have an eligible SIC code but you believe it has been incorrectly classified then you can apply to change the SIC code.

For businesses that do not have the exemption, it is important to understand how your supplier will be applying this charge and then to ensure it is applied correctly.

Navigating the EII Support Levy UK and EII exemptions can be complex. SeeMore Energy offers expert support to:

- Assist with applying for an EII exemption certificate.

- Guide you through re-classifying incorrect SIC codes.

- Verify that the EII Support Levy is correctly applied to your energy bills.

Contact SeeMore Energy today to speak with experienced advisers who can help you manage your energy bills and ensure compliance with the EII Exemption Scheme.

Contact Us