Why electricity prices keep going up

Why electricity prices keep going up

By Adam Novakovic

Electricity has always been more than just a utility it is an essential component in every part of UK business. Yet in recent years, costs have been climbing steadily, and today’s bills are weighed down by more than just wholesale market prices. There can be long periods of time where wholesale prices remain stable or decrease, yet the amount businesses are paying for their electricity continues to rise. A large part of the increase comes from policy decisions. Most notably the way the UK has chosen to fund decarbonisation, its reliance on renewables, and its failure to make a serious commitment to nuclear energy.

The transition from fossil fuels to renewables has been a defining change in the energy system. The focus was shifted towards renewables seemingly without fully considering how they would impact energy costs. They have helped cut emissions, but the trade-off is unpredictability. Weather-dependent generation cannot replace the reliability of coal or nuclear, so the grid must work harder and spend more to keep supply and demand in balance. Every time the wind drops or demand spikes, businesses end up paying for the back-up capacity and balancing services that keep electricity flowing.

Instead of funding renewable subsidies and system upgrades through general taxation, successive governments have embedded these costs in electricity invoices as non-commodity charges. For many businesses, these costs now make up more than half the total cost of electricity. This means that investments in green energy are then passed on to end users. For companies competing internationally, this means operating with higher energy costs than rivals in countries where policy has taken a different path.

Source: Trading Economics

One of the biggest reasons for prices increasing comes from the expansion of the grid itself. Many of the UK’s largest wind projects are located hundreds of miles from the major centres of demand, often offshore. Transporting that power requires billions in new network infrastructure. Current estimates suggest around £60 billion will be spent on reinforcement and expansion over the next decade, and once again these costs are incorporated into business energy bills.

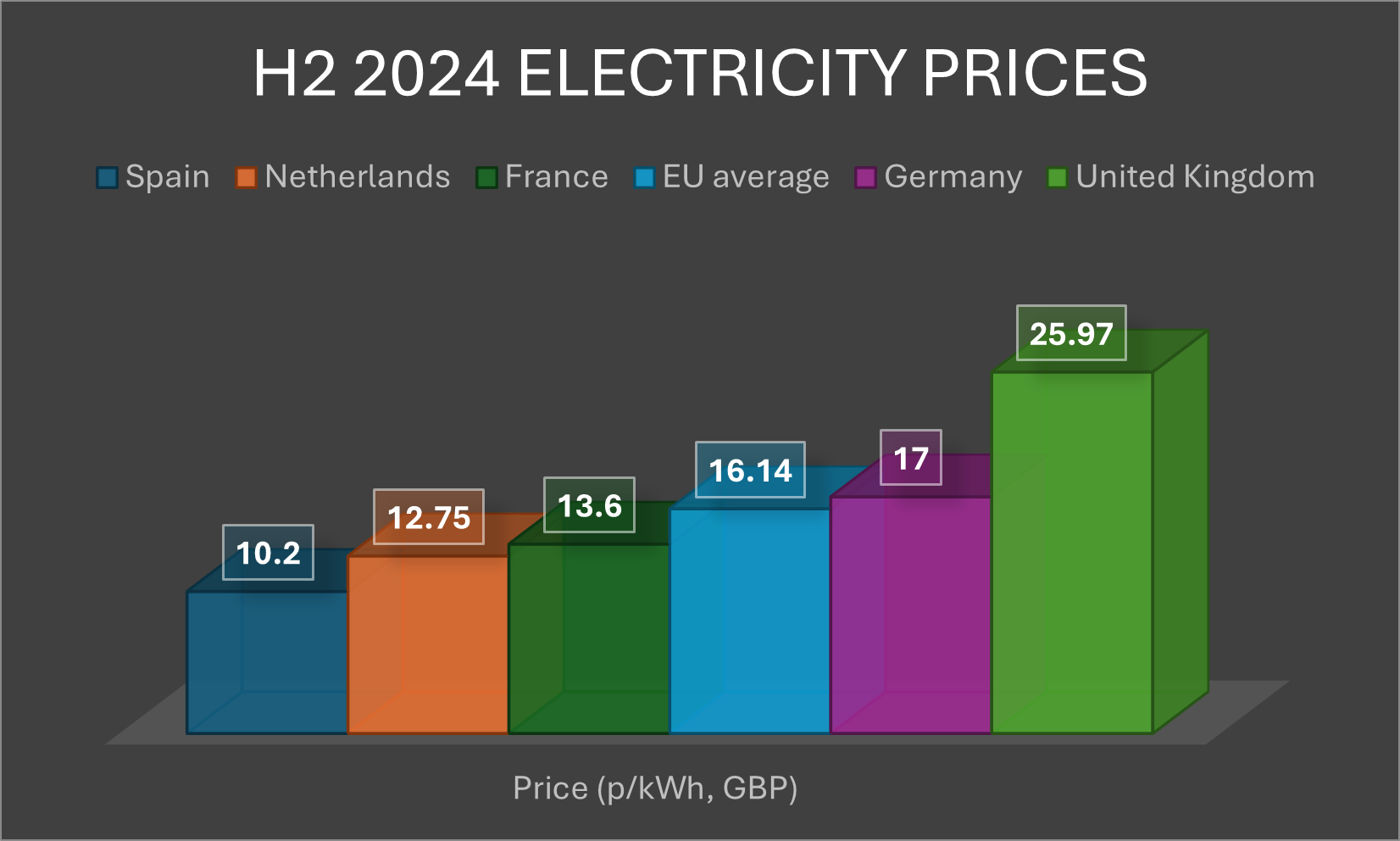

This is where the comparison with France becomes unavoidable. France generates around 70% of its electricity from nuclear power. This gives it a stable, low-carbon baseload supply at predictable cost, insulating businesses and households alike from some of the volatility that impacts the UK system.

Britain, by contrast, allowed its nuclear fleet to decline without adequate replacement. Projects like Hinkley Point C are years late and billions over budget, leaving a gap that has been filled with more expensive measures: subsidies, balancing payments, and LNG imports.

The UK is pursuing one of the most ambitious decarbonisation programmes in the world through its Clean Power 2030 plan, but without nuclear providing a reliable carbon-free energy-production, the price of that ambition is paid by the consumers.

In many ways, it appears as though the focus on clean energy has come at the expense of both businesses and consumers with a lack of economic consideration being given throughout the goal-setting process.

The financial evidence is clear. In 2000, businesses paid approximately £40/MWh. Today, the average is closer to £200. Wholesale market volatility and global supply factors have played a role, but the long-term upward trend is driven far more by policy and environmental levies than by commodity markets.

For businesses, this means facing multiple challenges: absorbing higher costs today, while planning for even more in the years ahead. Flexibility and efficiency are now strategic necessities. It is essential that a business consider reviewing procurement strategies, adjusting operations to avoid peak pricing, or investing in on-site generation can all help offset some of the policy-driven costs.

However, these steps can still make it difficult to compete with foreign companies who are able to source cheaper energy.

Electricity in the UK is expensive, not because low-carbon energy is inherently costly, but because of how the transition has been handled. By ignoring nuclear and relying so heavily on environmental charges added directly to invoices, the government has turned business energy bills into a decarbonisation tax.

If your business requires help with energy procurement, management, or strategies, contact SeeMore Energy today to see how one of our specialists can help your business reduce energy costs.

Contact Us