Preparing for Winter 2023

Preparing for Winter 2023

Within the UK energy market, electricity and gas wholesale prices are split into different seasonal markets. These seasons cover different periods of time and allow us to see the current price for a set month, quarter, or season.

Each price gives us an idea of the expected supply and demand levels during the stated period and understanding the different markets and their pricing dynamics allows us to create buying strategies targeted towards identifying when is likely to be the most opportune time to make energy purchases.

In this article we will be discussing the price movements for the Winter 2023 market, which covers October ’23 – March ’24.

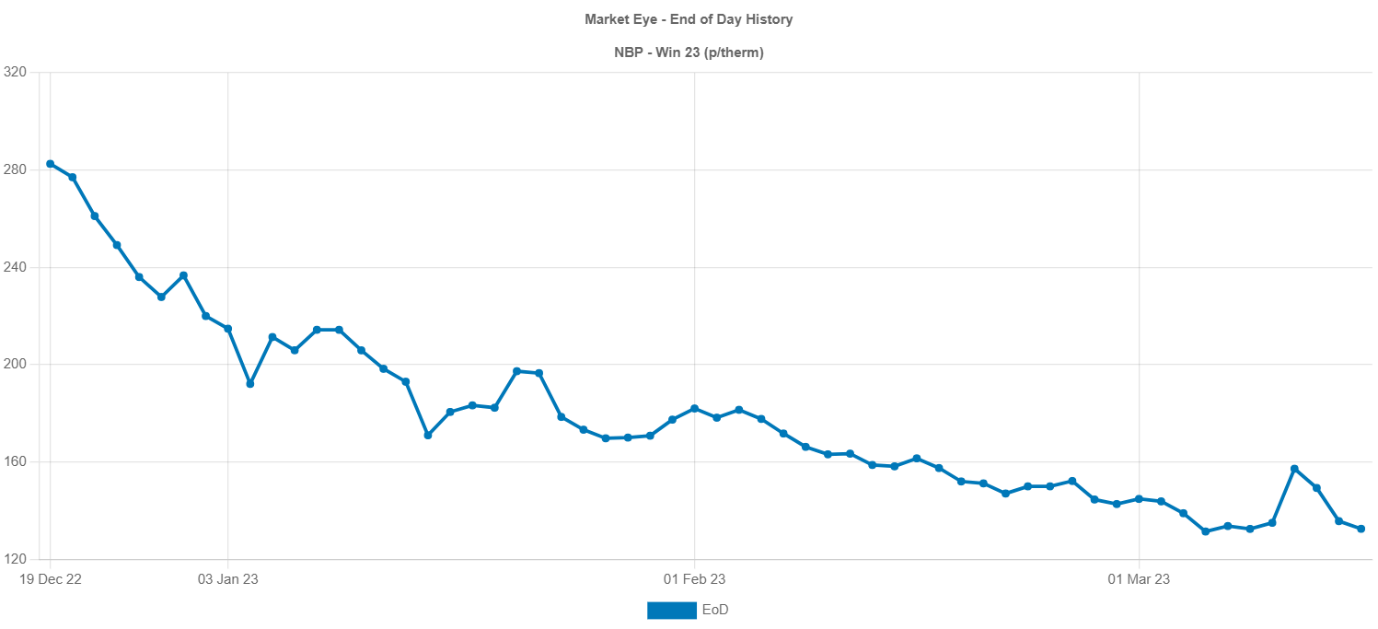

Winter ’23 prices since December 19th

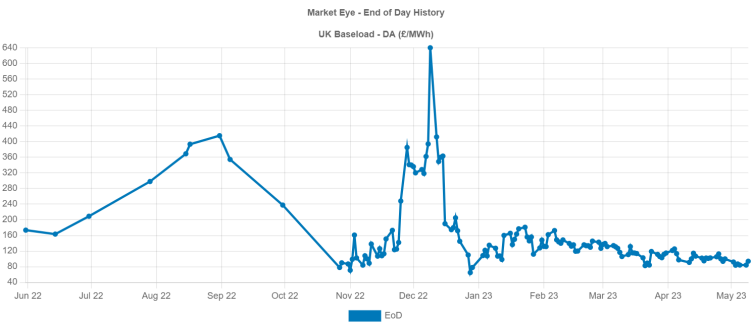

Looking at the latest 3 months of gas and electricity prices we can see a clear trend. Prices have fallen to roughly half of their mid-December levels.

Heading into winter ’22 there was a lot of fear in the market. Prices had risen sharply during the previous year, and whilst they had dropped from their August high, there was still far more volatility than the market had experienced in recent years.

The Winter ’23 prices have now fallen to a level last seen around the beginning of April ’22.

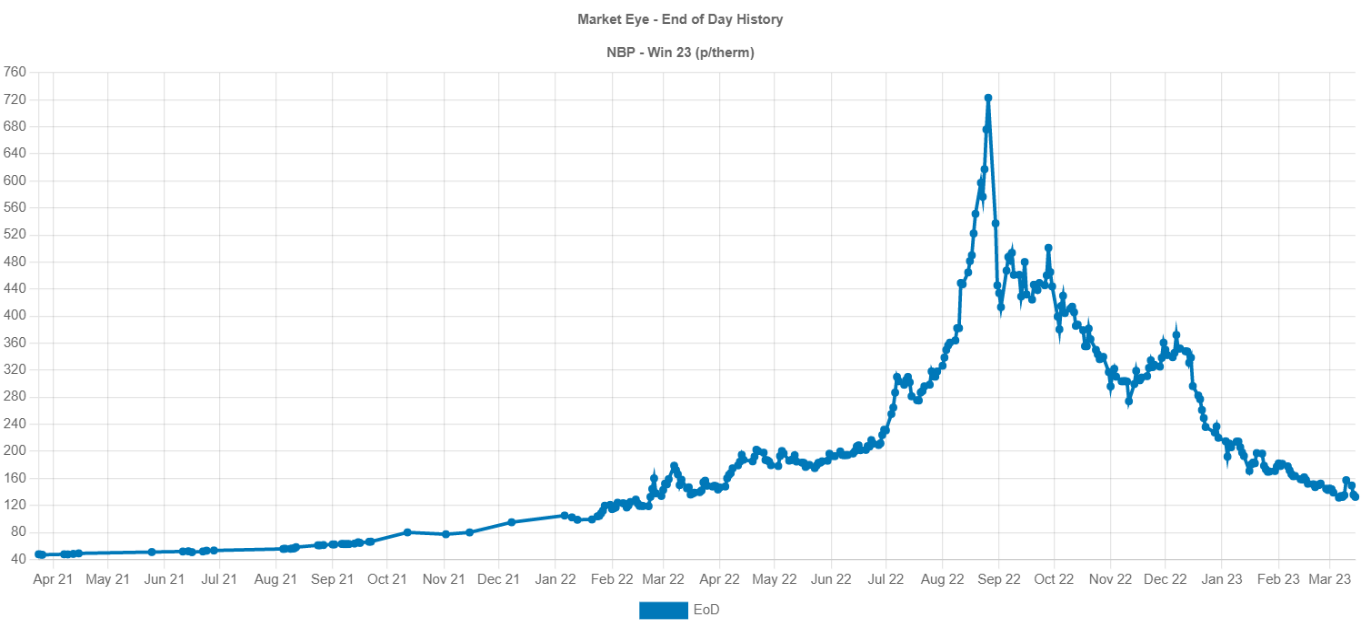

Winter ’23 prices

The main driver of the price increases last year were the supply-shortages largely caused by the conflict in Ukraine. The European market struggled to find ways to make up for the shortfall in supply and there were fears that deficits could occur.

We now know that these shortages didn’t materialise as originally forecasted. In-part due to a mild winter, purchasing from other sources, and measures taken to reduce unnecessary usage. Despite this, fears remain in the market and there remains an increased awareness of the potential for shortages, particularly if there is a colder than normal winter.

With these fears and caution still in place it seems unlikely that the market will fall to pre-2022 levels in the short-term, but will it keep falling further?

Without possessing a fully functioning crystal ball it’s difficult to say with certainty. What we can do however is look at the factors that will serve as catalysts for future price movements.

The majority of the UK’s gas comes from the North Sea and from Norway. Any disruptions to either of these supplies would have a negative impact on price, however, it doesn’t seem particularly likely that any such disruptions will take place at this time.

Weather always plays a key factor in demand. An unseasonably hot summer or cool winter can lead to increases in demand leading to increased prices and the climate has become harder to predict in the last few years.

2022 saw numerous issues with infrastructure across Europe. Damaged pipelines, nuclear plants being shut down, rivers used for transportation drying up and no longer being functional all contributed to problems with supply and led to increased prices.

If we don’t see any such problems and no major geopolitical issues occur then we can reasonably expect the fear to dissipate from the market and prices to slowly decrease. However, with there still being trepidation in the market we could see an overreaction should any problems occur, particularly if it something that receives significant media coverage.

As we’d always conclude, knowing how best to navigate energy markets can be complex and daunting, with no single strategy consistently working best, but with the assistance of SeeMore Energy, we can help create a clearly defined and understood strategy that allows you to confidence of knowing the market is being monitored on your behalf in the hands of an expert.

If you’d like us to provide a bespoke market tracker report to highlight how we would perform as your trusted energy partner, email

craig@seemoreenergy.co.uk and he’ll support.