2024 Review

2024 Review

By Adam Novakovic

In a year that began with falling energy prices, there were recurring catalysts that led to prices climbing steadily higher. Geopolitical uncertainty and the perennial threat of escalating conflicts meant fear would maintain a constant presence in the wholesale markets. We will look back at the key energy stories from 2024, and how the energy markets are likely to shape up in 2025.

Quarter 1

The year began with cautious optimism as the UK’s gas reserve levels were healthy and prices for the Summer’24 season were in freefall. In February, prices pulled back to their lowest levels since 2021, and for the first time in a while, we identified that there was greater potential for upside risk than for further downward price movement:

“there now (exists) an asymmetrical element of risk should the market encounter a supply-side problem of significance.”

During February we had advised customers on flexible contracts that this was an ideal time for making purchases.

March would see prices begin to ascend again as international conflict would create problems with LNG imports, and we would highlight the geopolitical risks as an area for concern moving forwards:

“fears remain and there are potential negative catalysts that could lead to prices rising further, with the main factors to watch out for being based on geopolitical unrest.“

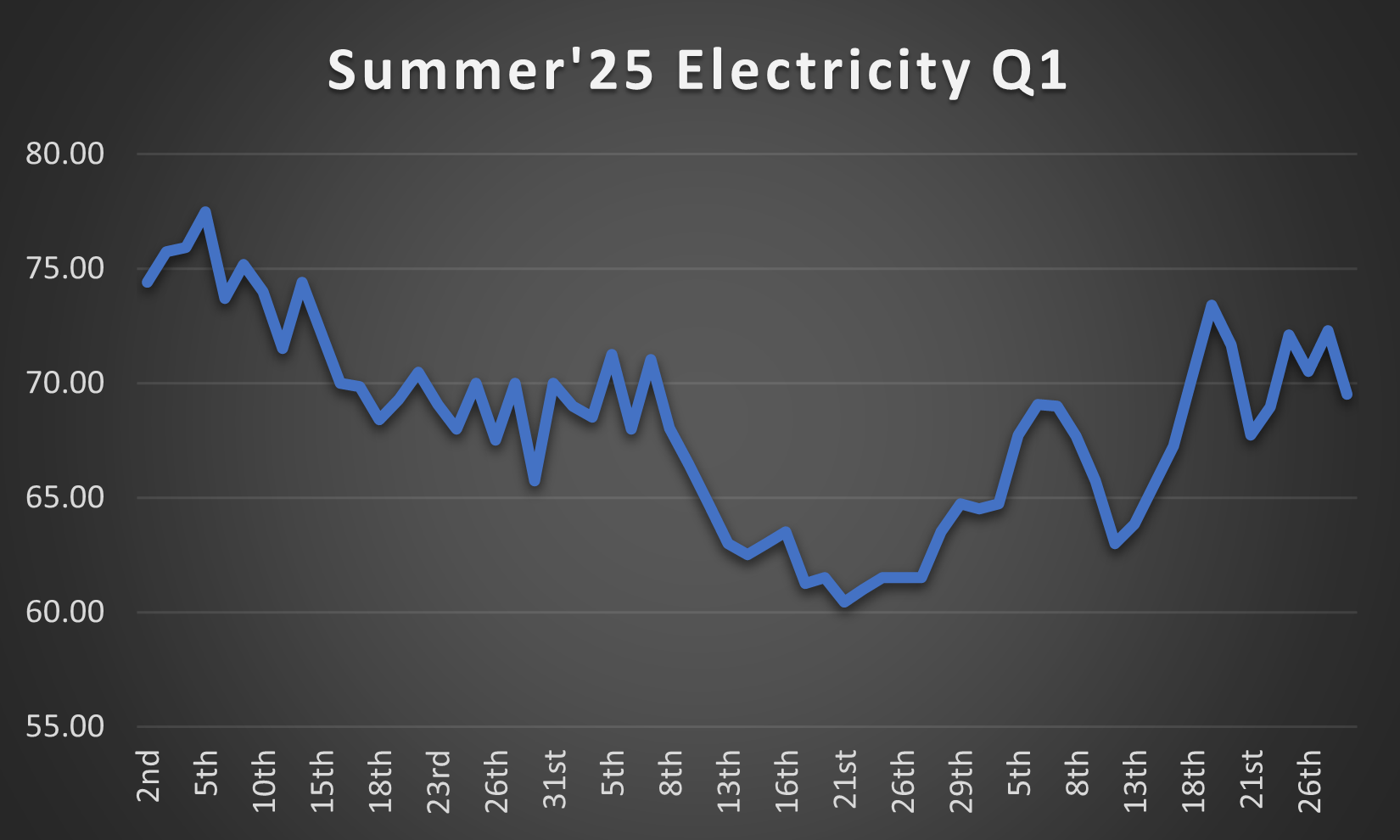

For a business that purchases their energy in advance, this quarter was the optimal time for purchasing during 2024. In February, electricity prices for Winter’25 were down to 7.75p/Kwh, and as low as 6.05p/Kwh for Summer’25. Winter’25 ended the year with prices above 11.1p/Kwh, with Summer’25 prices exceeding 9p/Kwh.

For a company that uses 500,000Kwh of electricity per month, the difference between buying at the February low point compared to today’s prices would represent a yearly saving of over £200,000.

Quarter 2

A colder-than-forecast April, combined with Norwegian gas production outages, led to prices continuing to rise. The disruptions to gas supply from Norway would be a prominent factor in price rises throughout the quarter as the threat of global conflicts disrupting LNG supplies further impacted the supply-side of the market.

In May, we highlighted the impact that global conflicts could have on energy prices:

“news out of the Middle East should be watched closely, as further disruptions to imports from Qatar could see prices rise further.”

Prices continued to rise in June as concerns regarding these conflicts escalated.

Gas reserve levels remained high but the UK’s reliance on imports led to fears in the energy markets, and this harmed businesses with high-energy consumption more than anybody else. While prices kept increasing it became more important for businesses to take necessary steps in reducing their consumption. To aid with this, we released our guide on helping manufacturing businesses lower their energy consumption and keep costs low: SeeMore Energy - Giving businesses that 'Lightbulb' moment...

Quarter 3

It had seemed as though prices were set to drop as we entered the second half of the year, but Hurricane Beryl hitting the Freeport LNG plant in the US and Iran being dragged into conflict in the Middle East put a halt to any optimism.

In July, we had seen the risk posed by upcoming outages at Norwegian gas fields:

“A potential problem that could impact prices in August is the Norwegian gas fields scheduled maintenance”. This would prove to be a factor behind price rises over the following 6 weeks as other factors would limit alternative sources of supply:

In addition to these issues, Russian and Ukrainian forces would clash near the Sudzha gas metering station creating concerns about energy security in the region. While heatwaves in East Asia were causing countries in the region to purchase more LNG than expected, increasing competition and prices in the global gas market.

By the end of September we were reflecting on price movement for the remainder of the year, and when we could expect energy prices to come down:

“While prices may be set to go higher on the news of further conflicts, there are reasons to be optimistic about the direction of energy prices beyond the coming winter. In 2025 we should see more LNG available to the market as new supplies”

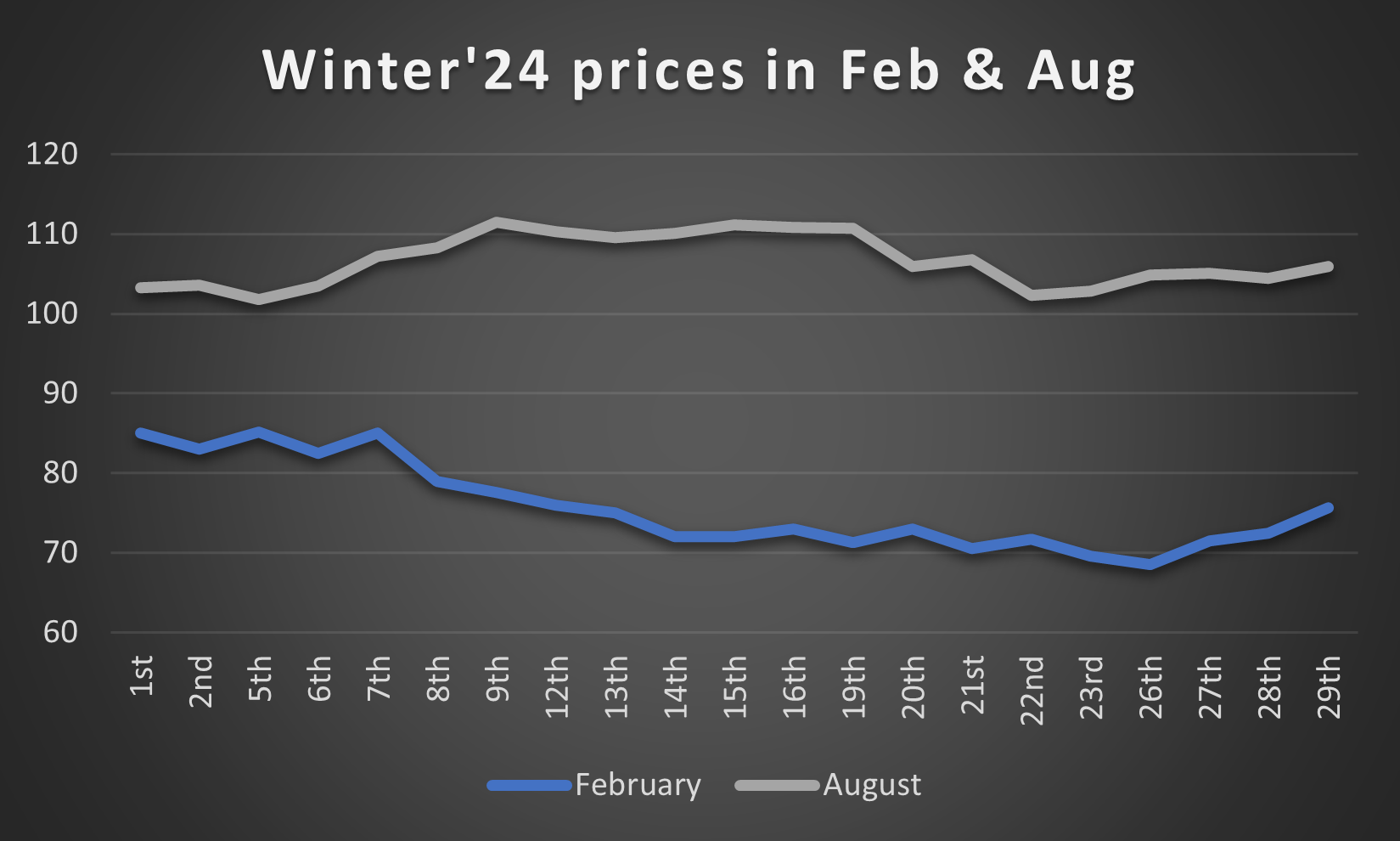

For a business that consumes 1,000,000Kwh of electricity during the Winter’24 period, purchasing at the time we had recommended in February (when prices were 6.85p/Kwh), compared to the peak price of August’24 (when prices hit 11.12p/Kwh), would represent an over £30,000 saving just for the winter period. Further highlighting the importance of timing purchases and how negotiating energy contracts at the right time can lead to significant savings.

Quarter 4

In the final quarter of the year the story of the ceasing Russian gas supply to Europe took prominence. Any hopes of the contract that expired on December 31st 2024 being renewed or a workaround being found faded as Ukraine refused to change their stance, despite increasing pressure from Slovakia.

Donald Trump’s election victory in the US opened up the prospect of increased US LNG exports from early 2025, but the more immediate threat of a colder than expected winter caused prices to continue rising.

In November we recommended that those with contracts due for renewal in 2025 try to hold off as long as possible as the supply picture would improve in the new year.

Outlook

The prices for electricity for the period of Winter’25 ended the year over 50% higher than they had been during the February low -- in spite of many fundamentals in the market being similar to this time. The threats of global conflict, erratic weather, and uncertainty about short-term gas supplies have kept wholesale prices high. However, with prices for future years being priced significantly below the current levels, this suggests that prices are set to drop in the near future.

As we move into 2025, it will be important to monitor the UK’s gas reserve levels as increasingly cold temperatures could cause short-term prices spikes. However, with Asia no longer in the midst of a heatwave and US LNG exports expected to ramp up quickly, the supply-side of the market should be more positive than it was for the bulk of 2024.

Global conflicts remain an X-factor, but with Europe no longer reliant upon Russian supplies this should have less of an impact than in recent years.

It seems likely that after the current winter there will be short-term buying to replenish the reserves, but once this is completed, we should see prices begin to steadily decline, and 2025 should see prices drop below the levels we saw in the 2nd half of 2024.

If your business requires advice with its energy procurement, management, or planning, then don’t hesitate to contact Seemore Energy to speak to experienced advisors who can help you with bespoke strategies and advice that is tailored to your needs.