Understanding Your Energy Bill: Environmental Charges

Understanding Environmental Charges on Your Energy Bill: FiT, RO and CCL Explained

This is the second article in our Understanding Your Energy Bills series. In this guide, we focus on environmental charges that appear on UK electricity bills and explain what FiT charges are, what RO charges are, and what CCL charges are -- and why businesses pay them.

While this article gives an overview, a more complete description of each individual charge can be found here:

- Renewables Obligation (RO)

- Contracts for Difference (CfDs)

- Feed in Tariff (FiT)

- Climate Change Levy (CCL)

What Are Environmental Charges on Energy Bills?

In 2019, the UK government committed to achieving net zero carbon emissions by 2050. To support this target, several environmental and renewable energy schemes were introduced.

These schemes are funded through environmental charges that are built into electricity and gas bills for households and businesses. While the charges may look small individually, together they can make up a noticeable proportion of overall energy costs.

What Are FiT Charges?

FiT charges relate to the Feed-in Tariff (FiT) scheme, which was designed to encourage households and businesses to generate their own renewable electricity, such as solar or wind power.

Under the FiT scheme, participants received payments for:

- Generating electricity (generation tariff)

- Exporting surplus electricity back to the grid (export tariff)

Although the scheme closed to new applicants, it is still funded through electricity bills.

How FiT Charges Affect Businesses

Businesses that do not generate their own electricity contribute to the cost of the scheme via FiT charges, which are applied as a surcharge on electricity consumption.

- Typically around 0.80–0.90p per kWh

- May vary slightly by supplier

- Mandatory for all suppliers to include

This is why FiT charges appear even if your business does not use renewable generation.

What Are RO Charges?

RO charges relate to the Renewables Obligation (RO) scheme, introduced in April 2002. The scheme required electricity suppliers to source a set proportion of their electricity from renewable generation.

Suppliers complied by purchasing Renewables Obligation Certificates (ROCs) from renewable generators. The more electricity a supplier sold, the more ROCs they were required to buy.

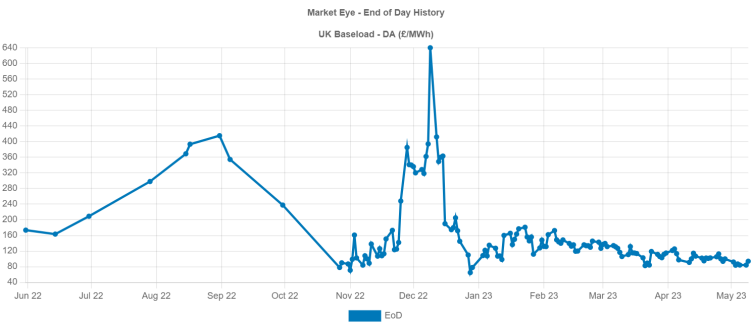

How RO Charges Are Calculated

The cost of purchasing ROCs is passed on to customers through RO charges on electricity bills.

- Charges vary slightly by supplier

- Between April 2022 and March 2023, RO charges were typically £30–£35 per MWh

RO charges remain one of the larger environmental cost components on business electricity bills.

What Are CCL Charges?

CCL charges refer to the Climate Change Levy (CCL), a government tax introduced in April 2001. It applies to most businesses and public sector organisations that use energy.

The purpose of the levy is to encourage improved energy efficiency and reduced carbon emissions.

Current CCL Rates

CCL is charged on energy consumption at fixed government-set rates, including:

- Electricity: £0.00775 per kWh

- Natural gas: £0.00672 per kWh

Unlike other charges on your bill:

- CCL rates are not set by suppliers

- The rate is the same regardless of supplier

- Changes are determined by government policy

How Is CCL Revenue Used?

Revenue from CCL charges is used to:

- Fund energy efficiency initiatives

- Support renewable energy projects

- Compensate energy-intensive industries for increased operating costs

CCL Exemptions

Some organisations may qualify for partial or full exemption from CCL, depending on:

- How and where energy is used

- Consumption levels (de minimis limits)

- Eligibility under Climate Change Agreements (CCAs)

Understanding what FiT charges are, what RO charges are, and what CCL charges are helps businesses gain clarity over the environmental costs included in their energy bills.

While these charges are largely unavoidable, understanding them can:

- Improve bill transparency

- Highlight exemption opportunities

- Support better energy and cost management decisions

Does Your Business Need Help Reviewing Environmental Charges?

If you’d like to know whether your business may be eligible for CCL exemptions, or if you want a clearer breakdown of the charges on your energy bill, Seemore Energy is here to help.

📧 Contact us for guidance and support and we’ll be happy to review your bills and explain your options.

Contact Us for advice or assistance with your energy bills