Wholesale gas charts

Wholesale gas charts

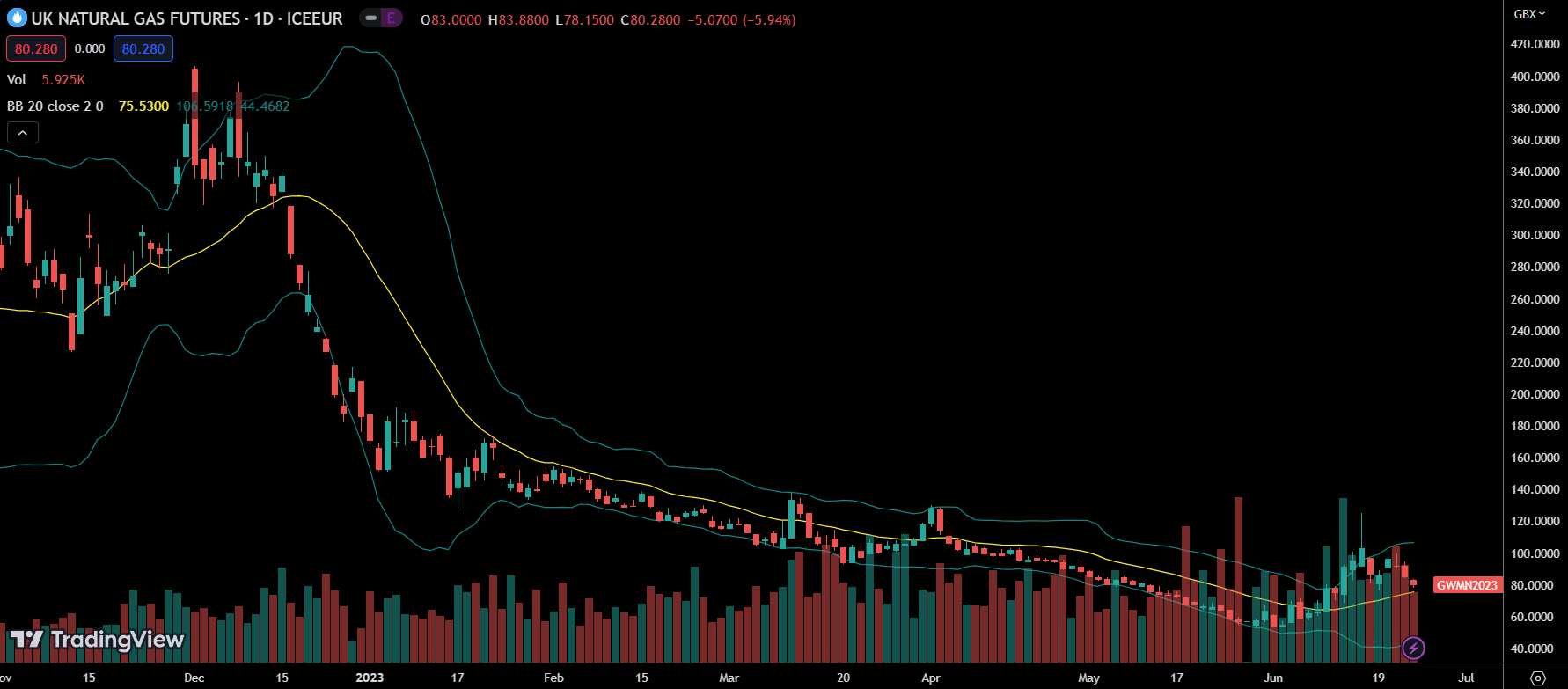

Throughout 2023 the price of wholesale gas had been steadily falling. After the potential shortages of winter 2022 failed to materialise -- and with many European countries maintaining healthy reserve levels -- there was a lack of fear in the markets. This was welcome after fear related to the Russia/Ukraine conflict and supply concerns had driven prices to unprecedented highs in 2022. However, June saw a change in the trend of consistently falling wholesale prices. Prices started going back up, and the intraday high seen on the 15th of June had taken the price to double what it had been 15 days earlier. The price has since pulled back from that intraday high, but we still saw last week’s closing price represent a 33% increase from the levels seen on June 1st.

So what caused this rise in price?

One of the main factors has been an extended outage in a Shell-owned Norwegian gas processing plant. The UK imports roughly 1/3rd of it’s gas from Norway, and any significant problem with Norwegian production has the potential to quickly impact UK gas prices.

The large price spike on June 15th was likely caused by the news that the Netherlands will be closing Europe’s largest gas field in 4 months’ time. The removal of the Groningen-produced gas as an option for European supply takes away what was seen as a vital buffer.

Without the potential to ramp up production in Groningen, countries will need to be increasingly diligent in ensuring they have back up supplies for the upcoming winter. This could lead to increased buying on the wholesale market in the run up to winter 2023.

The change in trend follows a period where price levels had been consistently below their 20-day moving average for the first 5 months of the year. The two previous times the price had risen above the moving average this year had seen price fall back below the moving average within 3 days. This time we are seeing a more sustained spell above the average which could indicate a change of trend.

Throughout June we have seen a series of higher lows. This indicates that buyers are no longer patiently waiting for price levels to settle and are no longer waiting for a further low.

While current price levels are higher than at the start of the month they are in line with prices from mid-May. In May, buyers seemed more content to wait on the sidelines and see if further lows would arrive. In this moment, the buyers have moved from the sidelines and are now actively purchasing – a sign that many see there being little chance of a significantly lower price in the near future.

Without positive fundamental news it seems unlikely that price will drop much from the current levels in the immediate future and the potential for prices to rise further, as buyers compete to lock in their supply, seems to be the more likely possibility.

We will keep watching the charts closely, and if you need any advice in navigating the energy markets, feel free to contact one of our expert advisors at Seemore Energy to help with your energy monitoring, planning, or purchasing needs.