2025 Yearly Review

In a year where news coverage was dominated by Israel’s genocide in Gaza and the on-going conflict between Russia and Ukraine, geopolitical events played a key role in dictating the movements of the energy markets. In this article we take a look back at 2025, revisiting the stories that impacted energy prices, and look at what is likely to shape the gas and electricity markets in 2026.

The year started with the UK recording its coldest temperature in 15 years and gas prices rising in the wake of Russian gas ceasing to flow into continental Europe. News of the US lifting their LNG export ban offered some respite, but prices failed to drop in the first month of the year after they had risen sharply in the final few months of 2024.

In February, milder-than-expected weather combined with the commencement of peace talks between Ukraine and Russia brough some optimism to the markets. This saw prices for Summer’25 gas and electricity drop by approximately 15%.

Prices continued to decline in March, although the EU issuing mandated gas reserve levels meant there would be an increased buying pressure which would keep prices propped up for the coming months.

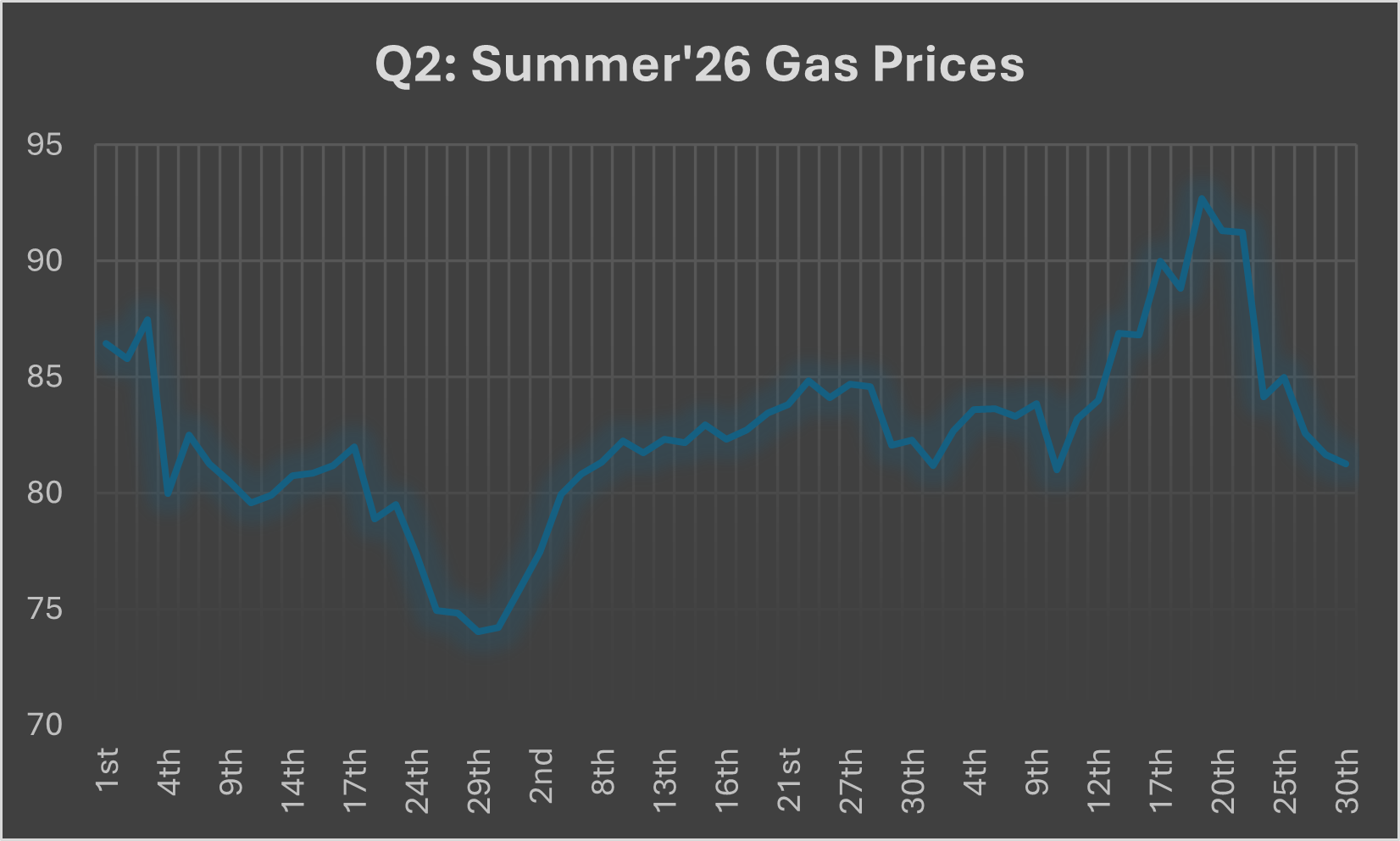

Q2

The trend of wholesale energy prices falling continued into April, where prices for Summer’26 gas fell by almost 15%.

This April price drop was largely due to unseasonably warm weather domestically, and the US imposing tariffs that caused production cuts which led to lower energy consumption internationally.

This meant that for a business set to consume 100,000 therms (2,930,713 kWh) during April-September of 2026, if they had purchased their gas for this period at the end of April, they would have saved approximately £20,000 compared to the prices at the start of January.

At this time, we acknowledged in our monthly review for April that:

“the market is still volatile, and tariffs being repealed or increased conflict in Ukraine could lead to prices rising again.”

This was shown to be prescient as increased tensions between Ukraine and Russia, maintenance of Norwegian gas fields, and the potential of conflict between Israel and Iran caused prices to rise in May.

When we then stated that:

“it seems as though multiple catalysts are in place that could drive prices up in the coming months... it seems that even further progress in Russian/Ukrainian peace talks may not be enough to cause another significant drop in prices…the market will likely react more sharply to any negative news impacting these supply chains.”

This proved to be the case as prices rose in June due to international conflicts threatening to disrupt global supply routes. Wholesale markets rose by 25% during the month, before news of a cease fire helped prices return to previous levels.

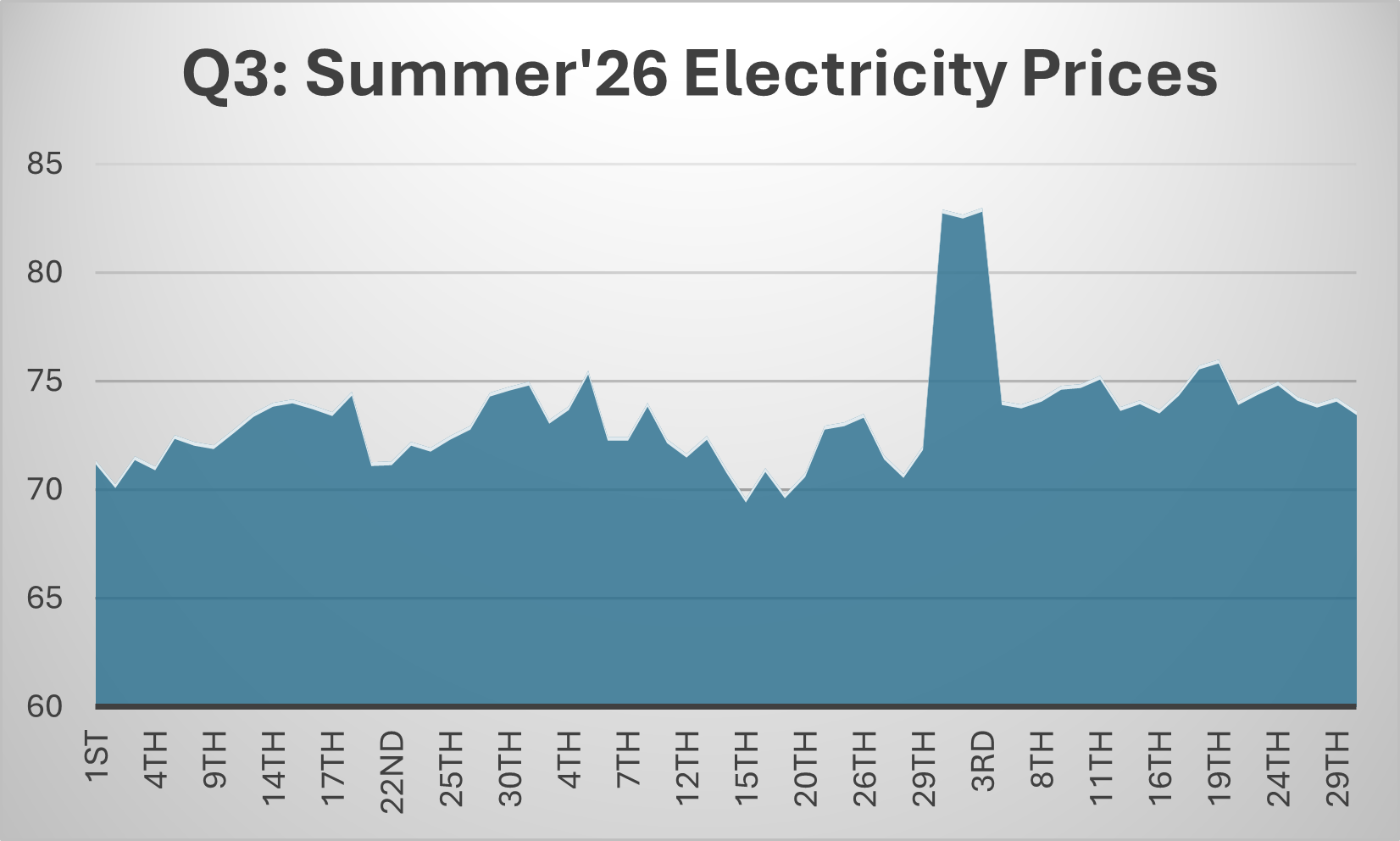

Q3

Prices remained volatile in July as fears increased about whether EU gas reserve goals would be met, however, prices began to fall again in August when data showed that most nations were set to hit their targets.

At the end of August, we wrote:

“ it appears that restrictions to supply from Russia will have a muted effect compared to 3 years ago. While this caps the potential for price rises, the possibility of Russian pipelines being re-opened to European markets still has the potential to lower prices.”

The markets would continue trading in a flat range throughout September, with little change in prices being observed. At this time – with the mandated buying coming to an end – it became clear that prices looked set to drop, and we stated as much in our September review:

“With European buying pressure dropping off and there being no clear, imminent threats to supply, it seems as though prices could be set to drop over the coming months.”

This would come to fruition in the final quarter of the year, when wholesale prices dropped significantly. Although, despite these drops in price, rising standing charges would mean few businesses would see the benefit of this decline.

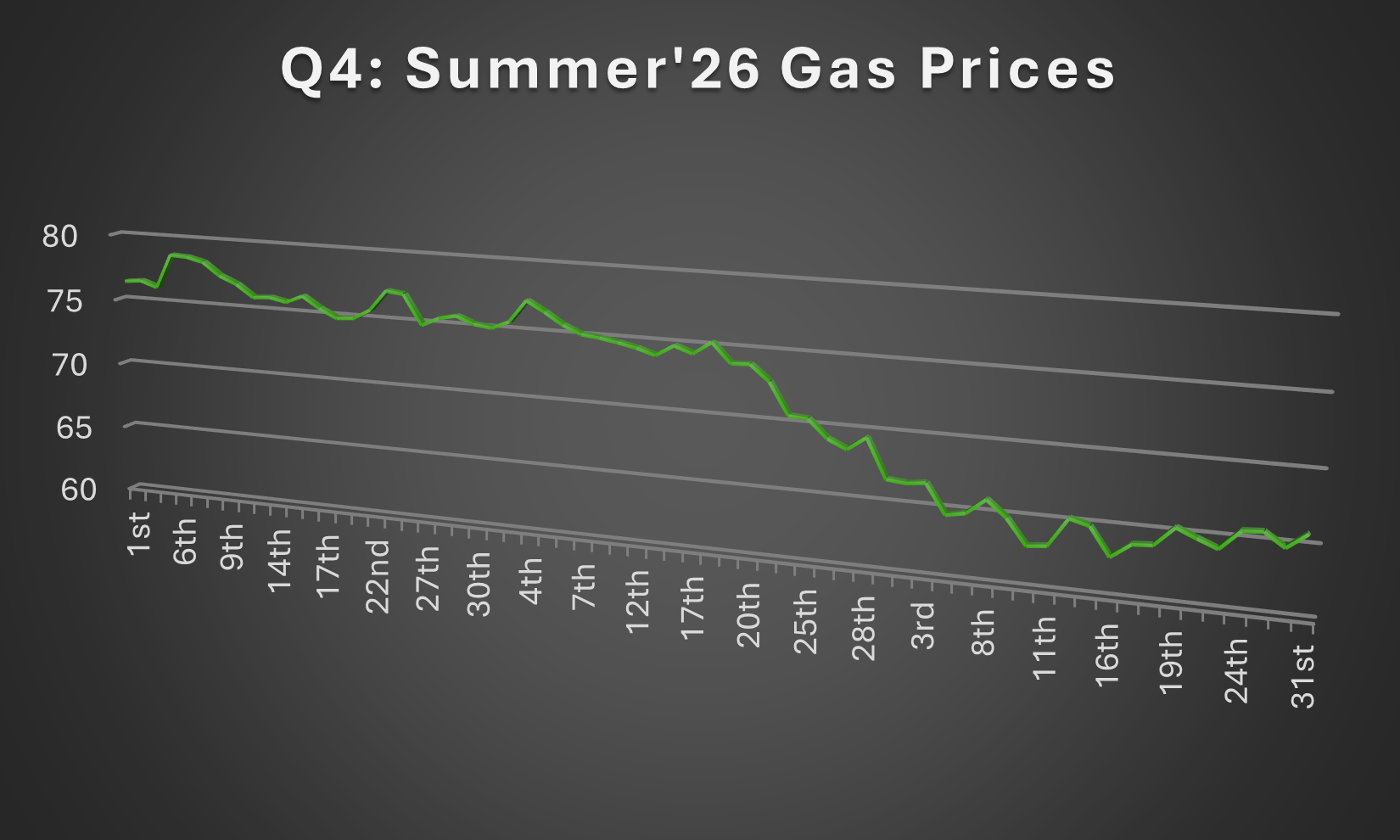

Q4

After a relatively uneventful October, prices began to fall during November, with wholesale gas prices reaching their lowest levels since July’24. After a budget that offered little relief to UK businesses hoping for assistance with their energy costs, further news of peace-talks between Russia and Ukraine did however offer some hope, as prices dropped on the back of this news.

With the European state buying pressure now removed, prices were able to hit their yearly lows as we entered December. Prices then continued to drop in the first week of the month before stabilising slightly as forecasts emerged of colder-than-expected weather for the end of December and early part of January.

At the end of December, it was confirmed that TUoS and DUoS prices would be set to significantly increase in April. For some businesses these can be charged as individual line items, but for others it will be added via their standing charge.

For the business looking to buy 100,000 therms of energy for Summer’26, the difference between the yearly high in February, and the low in December, equates to a difference of over £45,000. Further highlighting the importance of when to time your energy purchases.

For this period, gas prices had dropped over 30%, however, electricity prices had dropped by less than 5%. Historically there had been a stronger correlation between gas and electricity prices but this correlation seems to have been weakened by the percentage of the UK’s electricity now generated by renewables. This high volume of renewable generation has long-term positives but has also been largely responsible for the rise in non-commodity costs. The amount of work and investment necessary to update the existing grid infrastructure is the primary driver behind standing charges rising so significantly in recent years.

2026 Outlook

In the early part of the year, weather is set to be a key driver behind prices. Forecasts are suggesting that there will be an increased risk of storms and colder than usual weather up until the 20th of January, but after this we should see milder conditions. For those looking to renew contracts or make energy purchases in the early part of the year, February looks likely to be the sweet spot between poor weather conditions and European nations once again looking to replenish their gas reserves.

With the Suez Canal set to reopen, this offers increased shipping options and could lower transport costs, but any further military action in the Middle East would likely send prices higher.

Any peace deal between Russia and Ukraine that would allow for Russian gas flowing back into Europe would send prices lower, but this doesn’t seem likely to happen in the immediate future.

LNG exports are expected to increase with the US and Qatar both adding to their export capacity. Norway is also expected to increase their gas exports from 2025, meaning the supply side of the picture is looking healthy for the UK.

On the demand side, Chinese demand is expected to increase following a muted 2025-- as a result of US tariffs being imposed -- however, it seems likely they may be a major purchaser of energy from Russia and not necessarily in direct buying competition with European nations. They also have well-stocked coal supplies and don’t adhere to the same environmental guidelines as most European nations.

In summary, without geopolitics yet again having a strong influence on the markets, gas and electricity could see one of the most stable years in recent memory, with a slight decline expected. However, dismissing the possibility of geopolitical factors dominating the energy landscape seems overly optimistic, and constant adaptations to ever-changing global conditions will once again be a necessity.

It should also be noted that any drops in wholesale energy prices may be negated by the rising non-commodity costs and standing charges. From the 1st April, the new TUoS and DUoS rates will take affect, further increasing the energy costs for UK businesses, most notably for high-volume consumers.

If you want to keep up to date with the news impacting UK energy prices, we publish our monthly reviews on the first working day of the month, both on our website and on Linkedin.

And if you have a gas or electricity contract due to expire in the next year and would like us to advise you on the optimal times to obtain quotes, or if you would like assistance with any of your business energy needs, contact SeeMore Energy today for no obligation advice from a team of experienced professionals.

Contact Us